Streamline company onboarding to ensure AML compliance

Accelerate your company onboarding process with our KYB widget seamlessly integrated into your platform. Easily collect essential business information and corporate documents (like certificate of incorporation, memorandum of association...) to automatically check the companies against business registers and screen them against sanctions lists, PEP and adverse media to assess the risks.

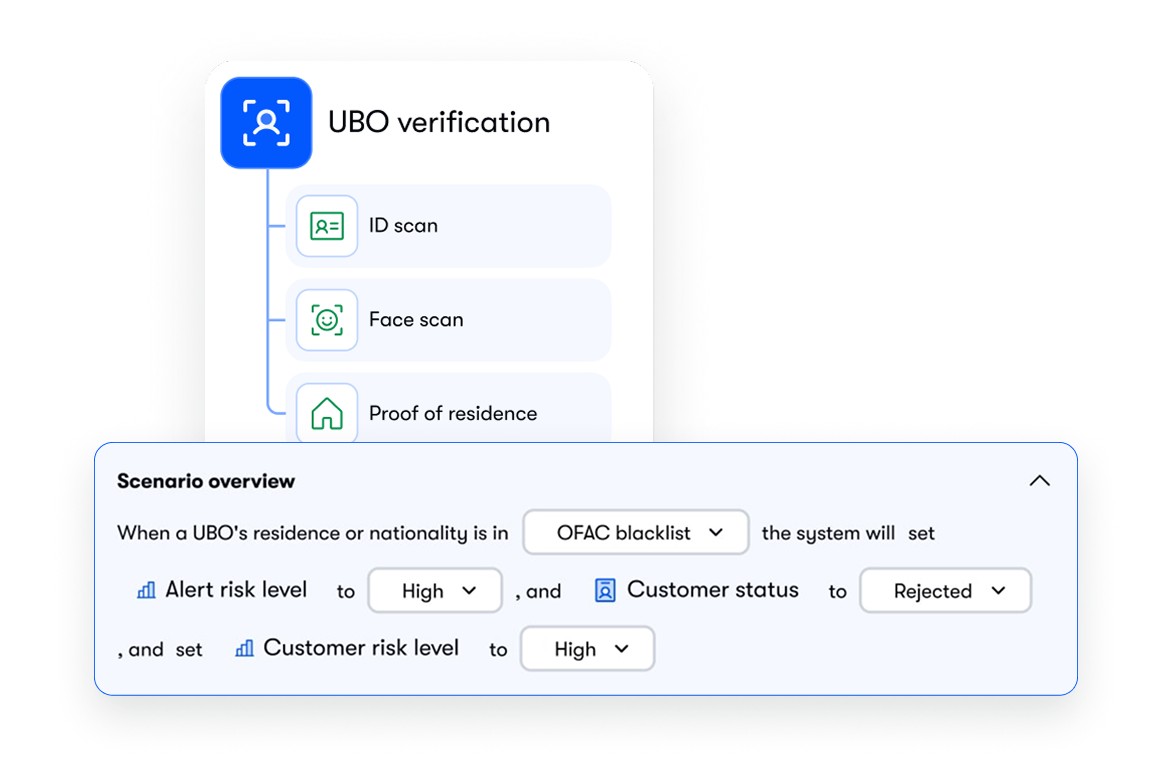

Conduct KYC checks on UBOs, shareholders and other company representatives

Ensure the legitimacy of companies by conducting thorough KYC checks on UBOs, shareholders, including ID, selfie, and liveness verification. Automatically identify UBOs and verify their identities to comply with global and local AML/KYC regulations.

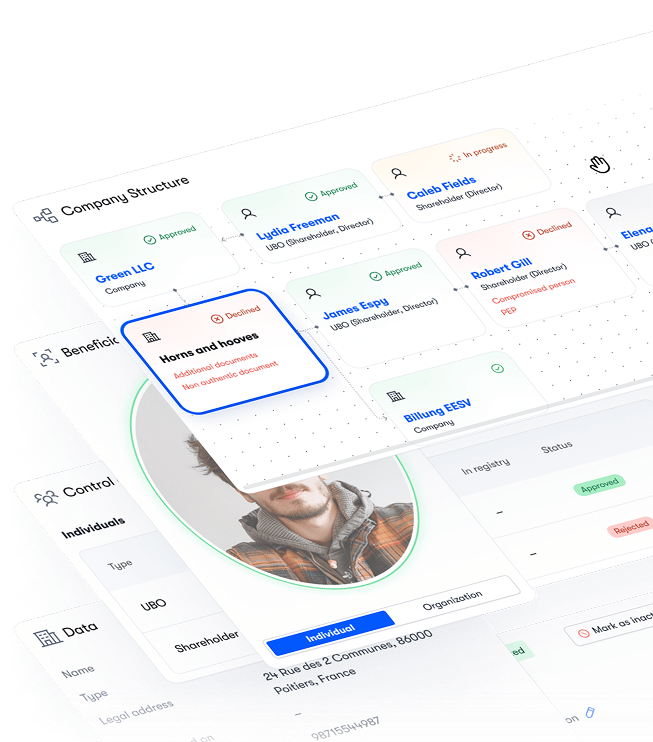

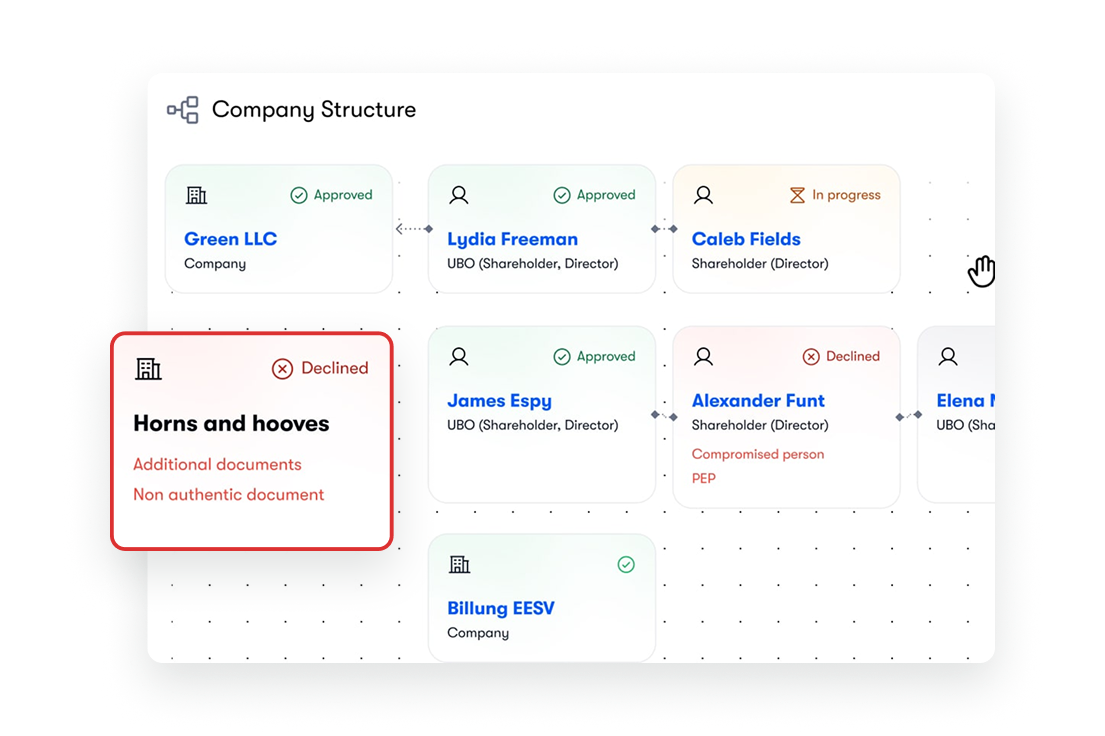

KYB and KYC dashboard

Gain deep insights into business structures thanks to our user-friendly company structure graph. Easily identify key executives and shareholders, understand ownership hierarchies and assess potential risks.

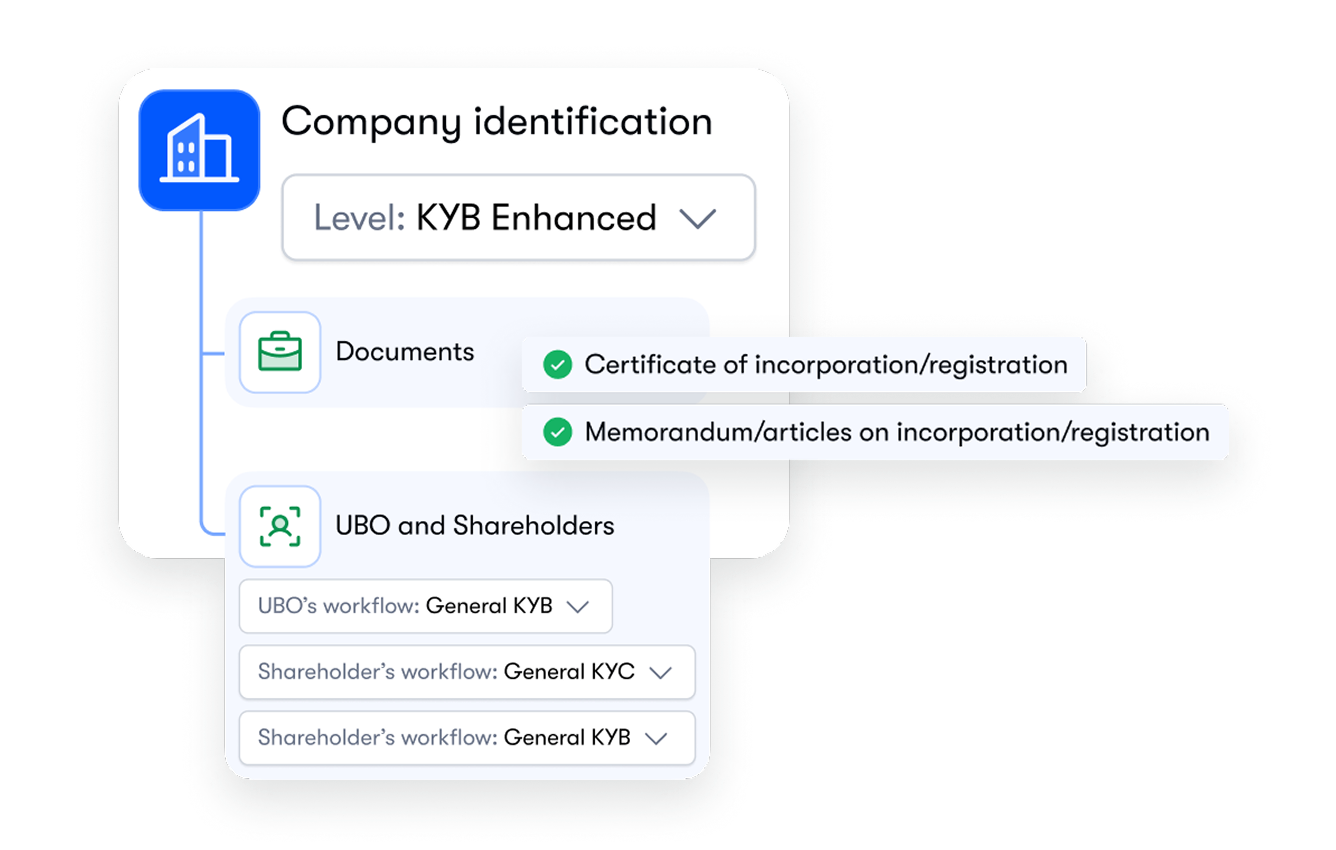

Tailor your KYB process to your specific needs

Customize your business verification process with our flexible rules engine to align with specific risk appetites and regulatory requirements. Set custom verification steps, trigger alerts, and prioritize workflows for optimal efficiency.

Loved by Teams Worldwide

Hear about Evergon from the ones who use it.

"Evergon offers exactly what a German-based startup like StegX needs: tools ensuring secure and compliant real estate tokenization, helping us navigate diverse regulatory landscapes. The experience has been truly exceptional."

"Working with the Evergon team has been a truly enjoyable experience. Their readiness to provide excellent support and their unwavering commitment to help at every turn has left a lasting impression on me.”

"ComPilot has been key in helping us achieve AML compliance efficiently with their easy-to-use web3-based solution.”

"ComPilot got clear structure and user guidance. It combines both solid project and user-friendliness as a one stop KYC tool!”

"Evergon took great care of understanding our various use cases and then assist us in the deployment of our marketplace with now over $500m of tokenized commodities and equity."

"Evergon is the default tech partner we recommend and use to manage the financial tokenization of Real Estate. Brilliant UX.”

"We tokenized a $210m renovation plan in Chicago. A first-of-a-kind collaboration handled perfectly by Evergon.”

"We use Evergon's infrastructure for our art tokenization platform. Their API is well thought, documented and easy to integrate.”

"Evergon took great care of understanding our various use cases and then assist us in the deployment of our marketplace with now over $500m of tokenized commodities and equity."

"Evergon is the default tech partner we recommend and use to manage the financial tokenization of Real Estate. Brilliant UX.”

"We tokenized a $210m renovation plan in Chicago. A first-of-a-kind collaboration handled perfectly by Evergon.”

"We use Evergon's infrastructure for our art tokenization platform. Their API is well thought, documented and easy to integrate.”

Answers at a Glance

Find quick answers to common questions about Evergon, from setup to security and support

What is Evergon Compliance solution?

Evergon makes compliant onboarding and monitoring of your customers effortless with a unique one-stop-shop tailored to Issuers and Investors. It integrates best-in-class providers (KYC, KYB, KYT, AML, Wallet Screening), consolidates all customer data and alerts, automates compliance tasks and provides smart dashboards.

What is Know-Your-Customer (KYC)?

Know-Your-Customer (KYC) is a set of procedures that businesses use to verify the identities of their customers and understand the potential risks they might pose (verification of government-issued ID, selfie, proof of residence...) . This is similar to how a bank might ask you for identification when you open an account.

KYC helps prevent and minimize fraud, money laundering, and other types of financial crime.. Most companies will need to employ an effective KYC tool to identify and verify their customers. ComPilot offers KYC as part of its all-in-one compliance solution.

What is Know-Your-Business (KYB)?

Know-Your-Business (KYB) is a process similar to KYC (Know-Your-Customer) but that focuses specifically on businesses. When a business signs up with a cryptocurrency platform, KYB helps verify the legitimacy and ownership of the company. This might involve checking business registration documents, information about the company's owners and directors, and the nature of the business and its activities.

KYB helps ensure that only reputable businesses are participating in the cryptocurrency ecosystem. This adds another layer of security and helps prevent fraud or misuse of the platform. ComPilot offers KYB as part of its all-in-one compliance solution.

What is Know-Your-Transaction (KYT)?

Know-Your-Transaction (KYT) is an important step in business processes that goes beyond just knowing who your customer is (KYC). While KYC verifies the identity of a customer using the platform, KYT focuses on the transactions performed on the platform. This involves monitoring the customer’s activity to identify any suspicious behavior.

By analyzing things like the source and destination of funds, transaction amounts, and frequency, KYT can help flag any activity that might be unusual or indicate potential money laundering, terrorist financing or other illegal actions. Companies operating in web3 space must employ effective tools for transaction monitoring. ComPilot offers transaction monitoring and wallet screening.

What is AML Customer Screening?

AML stands for Anti-Money Laundering. Money laundering is the process of trying to hide the source of money obtained illegally. AML Customer Screening is one of the ways ComPilot helps businesses comply with regulations to prevent money laundering from happening on their platform.

During AML Customer Screening, ComPilot checks the customers against special lists of people and businesses that governments and international organizations have identified as being high risk for money laundering or other illegal activities. These lists might include criminals, terrorists, or sanctioned entities. By comparing customers to these lists, ComPilot can help identify potential risks and prevent bad actors from using the platform for illegal purposes.

Still have questions?

Is Evergon the right fit for you? Get on the call with our professional tokenization and compliance team to find out what we can offer.

Built for ambitious teams with on-going operations.

The compliance suite was built in collaboration with investment firms and RWA players to help them go to market as in the most secure way possible within their regulatory market.

Raise capital faster with modern investment infrastructure.

Launch compliant offerings, onboard investors, and manage tokenized products without building internal systems.

Evergon reduces operational overhead and opens new, scalable distribution channels.

Bring real-world assets to market with a streamlined engine.

Tokenize assets, structure offerings, and automate the entire lifecycle from issuance to payouts.

Evergon handles identity, compliance, and on-chain operations so teams can focus on growth.

Operate secure and auditable infrastructures for tokenized assets.

Manage investor records, positions, and transactions with precision.

Evergon’s automated reporting and real-time ledgers remove manual reconciliation and strengthen institutional trust.

5

1

2

3

4

5

6

7

8

9

5

K

+

Dashboards

Created

8

1

2

3

4

5

6

7

8

9

8

8

1

2

3

4

5

6

7

8

9

8

+

Global

Integrations

9

1

2

3

4

5

6

7

8

9

9

9

1

2

3

4

5

6

7

8

9

9

%

Uptime

Guaranteed

Latest from the Blog

“Explore our use cases, releases and news cover to fuel your own business.”

Tokenize Your Assets Now

Start free today or book a demo to see how Evergon transforms your financial operations.